Benefit Fact Sheet

When a Service member is separated from active duty either because of completion of tour of duty, enlistment contract, disability retirement, as a result of the Selective Early Retirement Board, or regular retirement, and has not been unfavorably discharged, the Service member may be eligible for unemployment compensation. Unemployment Compensation for Ex-Service members (UCX) is a program mandated by federal law but administered by state governments. The Department of Labor's (DOL) Unemployment Insurance (UI) programs provide unemployment benefits to eligible workers who become unemployed through no fault of their own, and meet certain other eligibility requirements, such as able to work, available for suitable full-time work, and be seeking work.

Members of the Army Reserve in drill status are not normally eligible for UCX. If recently released from active duty due to  completion of mobilization tour or other active duty tour, they may file a claim for unemployment compensation the day after the date on line 12b of the DD Form 214. Criteria for eligibility to be paid unemployment compensation include reason of separation, characterization of service, and other eligibility requirements such as able to work, available for suitable full-time work, and be seeking work. Members of the Army Reserve or National Guard must have completed 180 days of continuous active duty service to be eligible for Unemployment Compensation.

completion of mobilization tour or other active duty tour, they may file a claim for unemployment compensation the day after the date on line 12b of the DD Form 214. Criteria for eligibility to be paid unemployment compensation include reason of separation, characterization of service, and other eligibility requirements such as able to work, available for suitable full-time work, and be seeking work. Members of the Army Reserve or National Guard must have completed 180 days of continuous active duty service to be eligible for Unemployment Compensation.

DOL's UCX program provides unemployment benefits to eligible workers who become unemployed through no fault of their own, and meet certain other eligibility requirements. The program is administered by each state, which may have unique requirements. Upon determination of eligibility, a weekly benefit amount is designated (up to the state's maximum) and then distributed weekly based upon meeting the eligibility requirements for that week, e.g., physically able to work, available to work, actively looking for work, etc. Claims cannot be filed until the day after the date on line 12b of the DD Form 214. Certain other criteria apply with regard to reason of separation and characterization of service to determine eligibility for UCX.

In many states, receipt of military retired pay from the branch of service (including in some instances military disability pay) is prorated to a weekly amount and subtracted from unemployment benefits that the retired Service member receives. Service members are advised to directly contact the state agency responsible for unemployment to understand state specific eligibility criteria, UC requirements and benefit amount determination, and obtain answers to questions.

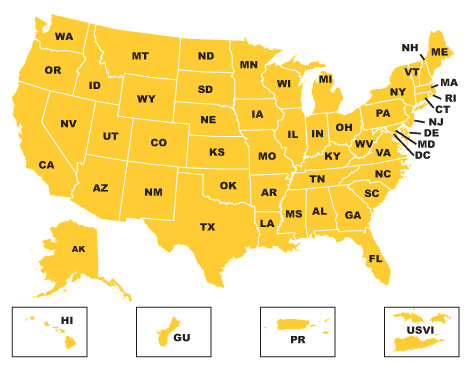

For more information, please visit the State Fact sheet for UCX information for the state where you reside:

Department of Labor's Career One Stop:

https://www.careeronestop.org/

Find each state or US territory unemployment benefits office, contacts, claim filing information:

https://www.careeronestop.org/localhelp/unemploymentbenefits/unemployment-benefits.aspx

Unemployment Compensation for Ex-Servicemembers (UCX):

https://oui.doleta.gov/unemploy/ucx.asp

Unemployment Compensation for Ex-Servicemembers (UCX) fact sheet:

https://oui.doleta.gov/unemploy/docs/factsheet/UCX_FactSheet.pdf